Convenience and Personal Service of an Independent Agent

Name

City

Phone

Type of Insurance Requested

Texas Only

Insurance Premium Increases

Question:

Why are my premiums going up?

Answer:

The cost of your homeowners insurance is going up in Texas, as it is across the country. Many factors can affect that cost, such as the deductible you select, the quality of your insurance coverage and the increasing value of your home; however, it is clear that rates are increasing for many customers.

Did you know:

-In the last five years, Texas has experienced losses from all five major catastrophes: hurricanes, wind and hail, floods, wildfires and earthquakes.

-The average property loss per homeowners policy in Texas is greater than the average premium in other states.

-According to the Texas Department of Insurance, thirty-five states have experienced average premium increases higher than Texas.

-According to the Texas Department of Insurance, the property insurance industry has been less profitable in Texas than it has been countrywide.

-Over the past sixty years, Texas has had the highest number of Federal Disaster Declarations.

We strive to find the best coverage for you at the lowest possible cost, but if you have questions about what you can do to decrease your premium, please call us.

This article was prepared and made available to your agent by the Independent Insurance Agents of Texas, which is solely responsible for its content. Please read your insurance policy. If there is any conflict between the information in this article and the actual terms and conditions of your policy, the terms and conditions of your policy will apply. The Independent Insurance Agents of Texas is a non-profit association of more than 1,500 insurance agencies in Texas, dedicated to helping its members succeed, in part by providing technical resources that explain insurance policies sold to their customers.

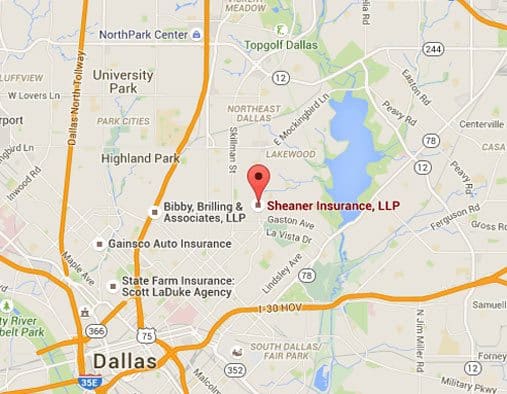

Sheaner Insurance Agency September 12th, 2019

Posted In: Articles