Convenience and Personal Service of an Independent Agent

Name

City

Phone

Type of Insurance Requested

Texas Only

Home, Auto and Business Insurance

Make the right choice with home, auto and business insurance from Sheaner Insurance Agency and experience the Convenience and Personal Service of an Independent Agent.

Make the right choice with home, auto and business insurance from Sheaner Insurance Agency and experience the Convenience and Personal Service of an Independent Agent.

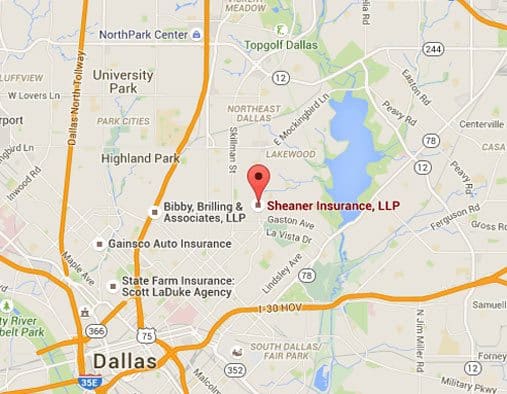

Herbert M Sheaner Jr Insurance Agency offers car, home, flood and business insurance of all kinds. Serving Dallas/Fort Worth and all parts of Texas (TX) since 1952. (reprint August 24, 1952)

We help before you buy to find the best combination of price, coverage, and service for auto, home, and commercial insurance. Call our experienced agents for a quote through one of the many companies we represent.

Read More About Your Agent

Se Habla Español

More Testimonials and Reviews…

Call or Visit our office for a personal review of your existing coverage or browse through the tabs at the top for more informative articles, insurance tips and recommendations or to request a quote. Start in the Car Insurance section to learn more about personal automobile and business insurance for commercial use vehicles. In the Property Insurance area you will find valuable information about Homeowners, Renters and Flood insurance. Look in Business Insurance for Workers Compensation, General Liability and Package policies for retail stores, manufacturing, office and warehouse buildings, apartments, artisan contractors, churches and more. Specialty Programs include Bounce House Rentals, Vendors, Special Events, Sports Camps & Clinics, Automobile Salvage Yards.

Contact us today for a quote

Pet Insurance for Dogs and Cats

Sheaner Insurance Agency is now offering Pet Insurance for dogs and cats through TrustedPals.

Select Quote for more information and immediate quote and payment options.

Sheaner Insurance Agency July 16th, 2020

Posted In: Articles

How to Protect Your Company from Business Email Hacks

One mistaken click can be costly if a hacker gains access to your business email account and uses that access to defraud your business of thousands – or even millions – of dollars. Watch Ken Morrison, a Travelers cybersecurity professional, show how an attack like this works, so you can recognize the signs and take steps to protect your business from cyber criminals.

Call our experienced agents for a quote through one of the many companies we represent. We help before you buy to find the best combination of price, coverage, and service for auto, home, and busiess insurance.

Serving Dallas/Fort Worth and all parts of Texas (TX) since 1952. (reprint August 24, 1952)

Sheaner Insurance Agency July 10th, 2020

Posted In: Articles

Insurance coverage questions amid the COVID-19 pandemic

Business Interruption

Business interruption coverage covers losses that result from direct physical loss to property. Generally, a virus doesn’t cause physical loss to property, but every situation will be looked into on a case-by-case basis. We encourage you to review your specific policy language. –Read More–

Workers’ Compensation

Workers’ compensation coverage generally applies if the employee was injured or became ill because of the type of job they have and in the course of performing that job. Every state has its own workers’ compensation insurance laws and regulations that govern the coverage available. –Read More–

Claims

Every situation will be evaluated on a case-by-case basis. If you believe you have had a loss, file a claim by calling your agent or the insurance carrier direct.

Premium Billing and Audits

We understand that many individuals and businesses are facing a significant financial burden due to COVID-19. To help ease that burden, many insurance companies have expanded billing relief for customers across Business Insurance, Bond & Specialty Insurance and Personal Insurance.

We’re committed to working with you and your customers during these challenging times.

Sheaner Insurance Agency March 28th, 2020

Posted In: Articles

What you need to know about coronavirus for your business

Texas Mutual Insurance Company will investigate each COVID-19 claim on a case-by-case basis. Their team of claim specialists will investigate the facts of each case and evaluate whether an employee’s illness related to COVID-19 occurred during the course and scope of employment. As with any claimed occupational disease, the medical evidence will be important to the compensability determination.

Report all claims that you suspect may be work related immediately.

Reported illnesses have ranged from mild symptoms to severe illness and death for confirmed cases of COVID-19 disease. The following symptoms may appear two to 14 days after exposure:

• Fever

• Cough

• Shortness of breath

Coronavirus (COVID-19) frequently asked questions for employers, provided by Texas Mutual Insurance Company

For additional coronavirus resources, including safety and claim information, visit the Texas Mutual blog.

Sheaner Insurance Agency March 4th, 2020

Posted In: Articles

Insurance Premium Increases

Question:

Why are my premiums going up?

Answer:

The cost of your homeowners insurance is going up in Texas, as it is across the country. Many factors can affect that cost, such as the deductible you select, the quality of your insurance coverage and the increasing value of your home; however, it is clear that rates are increasing for many customers.

Did you know:

-In the last five years, Texas has experienced losses from all five major catastrophes: hurricanes, wind and hail, floods, wildfires and earthquakes.

-The average property loss per homeowners policy in Texas is greater than the average premium in other states.

-According to the Texas Department of Insurance, thirty-five states have experienced average premium increases higher than Texas.

-According to the Texas Department of Insurance, the property insurance industry has been less profitable in Texas than it has been countrywide.

-Over the past sixty years, Texas has had the highest number of Federal Disaster Declarations.

We strive to find the best coverage for you at the lowest possible cost, but if you have questions about what you can do to decrease your premium, please call us.

This article was prepared and made available to your agent by the Independent Insurance Agents of Texas, which is solely responsible for its content. Please read your insurance policy. If there is any conflict between the information in this article and the actual terms and conditions of your policy, the terms and conditions of your policy will apply. The Independent Insurance Agents of Texas is a non-profit association of more than 1,500 insurance agencies in Texas, dedicated to helping its members succeed, in part by providing technical resources that explain insurance policies sold to their customers.

Sheaner Insurance Agency September 12th, 2019

Posted In: Articles

Building or Remodeling Your Home

We are building a new home [or remodeling our existing home]. Do we need any additional insurance coverage for this project? That is a great question, and one that our customers ask frequently.

Whether you are building a new home or remodeling your current home, there are some important insurance issues to consider. The homeowners insurance policy covering your existing home provides some coverage in these situations, but you may need some changes to your policy or additional policies.

Sheaner Insurance Agency July 17th, 2019

Posted In: Articles

Electric Scooter Rentals

Are you tempted to take a ride on an electric scooter rental? Here are a few things you should know about insurance before you take off. Check out these tips offered by Texas Department of Insurance

https://www.tdi.texas.gov/takefive/scooter-insurance.html

Sheaner Insurance Agency March 14th, 2019

Posted In: Articles

Tags: Scooter Rental Insurance

Gap Insurance

Loan or Lease gap insurance, you may have heard of it; if you finance or lease your vehicle and it gets totaled, loan/lease gap coverage can cover the difference between the current value of your vehicle and what is owed on it.

Read More …

Sheaner Insurance Agency April 18th, 2018

Posted In: Articles

How to Be Safer When Using Public Wi-Fi

Public Wi-Fi spots are everywhere these days. They are convenient, especially when you’re on the go, but they could also leave your information vulnerable. Here are some tips from The Hartford Steam Boiler Inspection and Insurance Company on how to use public Wi-Fi safely.

Link – How to Be Safer When Using Public Wi-Fi

Contact our office if you’re interested in protection for Commercial Equipment Breakdown, Data Compromise and Identity Recovery Insurance.

Sheaner Insurance Agency April 11th, 2018

Posted In: Articles

Basics of Homeowners Insurance

Click on image to play short Video

Basics of Homeowners Insurance

Home Insurance

Request a Quote

Application

Fax completed form to (888) 607-7154

Sheaner Insurance Agency February 27th, 2018

Posted In: Articles