Convenience and Personal Service of an Independent Agent

Name

City

Phone

Type of Insurance Requested

Texas Only

Home, Auto and Business Insurance

Make the right choice with home, auto and business insurance from Sheaner Insurance Agency and experience the Convenience and Personal Service of an Independent Agent.

Make the right choice with home, auto and business insurance from Sheaner Insurance Agency and experience the Convenience and Personal Service of an Independent Agent.

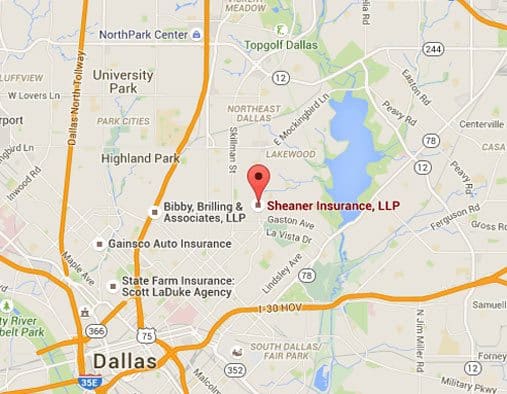

Herbert M Sheaner Jr Insurance Agency offers car, home, flood and business insurance of all kinds. Serving Dallas/Fort Worth and all parts of Texas (TX) since 1952. (reprint August 24, 1952)

We help before you buy to find the best combination of price, coverage, and service for auto, home, and commercial insurance. Call our experienced agents for a quote through one of the many companies we represent.

Read More About Your Agent

Se Habla Español

More Testimonials and Reviews…

Call or Visit our office for a personal review of your existing coverage or browse through the tabs at the top for more informative articles, insurance tips and recommendations or to request a quote. Start in the Car Insurance section to learn more about personal automobile and business insurance for commercial use vehicles. In the Property Insurance area you will find valuable information about Homeowners, Renters and Flood insurance. Look in Business Insurance for Workers Compensation, General Liability and Package policies for retail stores, manufacturing, office and warehouse buildings, apartments, artisan contractors, churches and more. Specialty Programs include Bounce House Rentals, Vendors, Special Events, Sports Camps & Clinics, Automobile Salvage Yards.

Contact us today for a quote

Disaster Assistance from FEMA Fact Sheet

If you suffered property damage or loss directly caused by Hurricane Harvey, you are urged to register with the Federal Emergency Management Agency (FEMA) and apply for disaster assistance – even if you have insurance. Help may be available for uninsured or underinsured losses or when insurance claims are not promptly settled.

Read More …

What to Expect when You Register for FEMA Disaster Assistance

How to Save Damaged Family and Personal Treasures

Texas Renters May Be Eligible for Federal Help

Sheaner Insurance Agency September 13th, 2017

Posted In: Articles

Are you prepared for a hurricane?

Are you prepared for a hurricane? Follow this checklist to stay safe and protect your home from a tropical storm or hurricane.

Build an emergency kit

Be ready for anything! Check out this list of recommended items: http://www.ready.gov/kit

Develop a family disaster plan.

FEMA’s Ready Kids Program gets the whole family involved in preparation. http://www.ready.gov/kids

Mobile-App

Check out this free mobile app award-winning app that helps you, your family, and even your pets prepare to safely get out of harm’s way before trouble starts. Use preloaded checklists to discover key mitigation and preparation steps, or create your own lists from scratch. Either method lets you set due dates, chart progress, and include notes, contact lists, and other information—and share your checklists with family and friends: Know Your Plan

Sheaner Insurance Agency August 24th, 2017

Posted In: Articles

Renters Insurance Requirements

Should apartment owners require tenants to have their own insurance coverage?

It is becoming more common for landlords to require tenants to have Renters insurance. It is often written into the lease agreement in many of the larger apartment communities. Tenant Homeowners, or Renters Insurance, is good for both owner and tenant;

Benefit to the Landlord:

- Adds a layer of protection to mitigate lawsuits involving tenant negligence

- Additional living expenses contained the Renters policy lessens the likelihood that you will need to provide temporary housing or reimburse expenses

- Reimburses your policy deductible when building damage is caused by tenant’s negligence

Benefit to the Tenant:

- Protects against loss of personal property due to fire, theft, vandalism or smoke

- Provides personal liability coverage worldwide

- Can be bundled with Automobile policy to reduce cost for both policies

Renters insurance is very affordable for most people with policies as low as $150/year. Your tenants can easily obtain a quote by calling us direct or completing a simple online quote request form at SheanerInsurance.com.

Additional information about benefits of requiring tenants to maintain Renters insurance can be found at https://www.landlordology.com/5-benefits-renters-insurance/

Sheaner Insurance Agency May 14th, 2017

Posted In: Business Insurance

Fire Place Safety & Maintenance Tips

When the colder temperatures start to set in, many homeowners will turn to their fireplace, wood or pellet stoves as an additional heat source. While fireplaces can provide warmth and comfort, if you are not careful, they can also be a hazard. Keep in mind the following precautions to help ensure a safe winter season.

Sheaner Insurance Agency January 27th, 2017

Posted In: Insurance Tips

Be Prepared with a Car Emergency Kit

Having a car emergency kit in your car is sort of like having good insurance. You hope you’ll never need it—but boy are you glad it’s there on road trips if you have an accident or need to help others.

If you become stranded, it can be critical to have the right supplies to speed up being rescued, say driver-safety experts. This is especially true in winter weather, when having the right supplies could also mean your survival.

It’s easy to be prepared for road trips. Auto emergency kits with most of these essentials cost $30 to $100 at stores that sell auto accessories. But you can also assemble your own car emergency kit. To be ready for any roadside emergency, here’s what you should include.

What Belongs in the Trunk

Use a sturdy canvas bag with handles or a plastic bin to store your auto emergency kit, and secure it so it doesn’t roll or bounce around when the car is moving. Include the following:

- Flashlight and extra batteries

- Cloth or roll of paper towels

- Jumper cables

- Blankets

- Flares or warning triangles

- Drinking water

- Nonperishable snacks, such as energy or granola bars

- Extra clothes

- First-aid kit

- Basic tool kit that includes, at minimum, flat-head and Phillips screwdrivers, pliers, and adjustable wrench

Winter Add-ons

Inventory your items in the winter and spring, and include these six items before the winter months:

- Window washer solvent

- Ice scraper

- Bag of sand, salt, or cat litter, or traction mats

- Snow shovel

- Snow brush

- Gloves, hats, and additional blanket

Glove Compartment

Not all emergency equipment should be behind the backseat or in the trunk. Here are three essential items to stow within the driver’s reach:

- Mobile phone

- Phone charger

- Auto-safety hammer (some have an emergency beacon and belt-cutting tool, too)

Call Us

Contact one of our agents at the Sheaner Insurance agency for a Quote or to help with your risk management plan. Also consider our agency when renewing your personal home, auto, boat, motorcycle and umbrella coverages. With more than 65 years in business we are able to provide great service, pricing and convenience with the many fine insurance carriers we represent.

Sheaner Insurance Agency January 16th, 2017

Posted In: Articles

Watch Out for Wildlife on Roadways this November

Texas has twice as many motorists killed in vehicles colliding with wild animals than any other state.

According to the Insurance Institute for Highway Safety (IIHS), more than 5,000 vehicle/animal crashes occur annually on Texas highways and on average, 17 people are killed every year in these crashes.… Continue reading

Sheaner Insurance Agency November 4th, 2016

Posted In: Articles

Lightning Facts and Fallacies

The next time you see or hear a thunderstorm, you might want to take a moment to review what you know about lightning safety. Strikes are most common during the summer thunderstorm season, but they can happen at any time of the year. And, a lot of less-than-accurate ideas about lightning have found a place in the popular imagination over the years. Here’s a look at current knowledge.

Indoor Safety

- The safest place to be during a storm is typically indoors, but it is important to avoid anything that conducts electricity – metal, landline phones, appliances, wires, TV cables and plumbing.

- Automobiles can be safe havens thanks to the metal frame that diverts the electrical charge. Don’t lean on the doors during a storm, though.

Outdoor Safety

- Don’t look for shelter under a tree. If lightning hits its branches, a “ground charge” could spread out in all directions.

- Don’t lie flat on the ground. This makes you even more vulnerable to a ground charge.

- Don’t crouch down. Once recommended, the “lightning crouch” has been discredited – it’s not likely any safer than standing if you’re outside during a storm. Instead, get inside or into a car.

Where Strikes Will Happen

- Contrary to folk wisdom, lightning does indeed strike twice in the same place. The best example is New York City’s Empire State Building. It was once a lightning laboratory due to being struck scores of times every year.

- Lightning doesn’t only strike the tallest objects. Although tall, pointy, isolated objects are often hit, lightning has been known to hit the ground instead of buildings and parking lots instead of telephone poles.

- The presence of metal doesn’t affect where and if lightning will strike. Neither mountains nor trees contain metal, and both get struck. However, metal is a conductor of electricity, so avoid it during any storm.

- Strikes don’t just happen in areas where rain is falling. Even if you’re miles away from a thunderstorm, lightning can still occur.

Finally, it’s important to remember that you won’t be electrocuted if you touch someone who has been struck – the human body doesn’t store electricity. So, by all means, give a lightning strike victim first aid. You might just save a life.

Consider our agency when renewing your personal home, auto, boat, motorcycle, umbrella or business insurance. With more than 62 years in business we are able to provide great service, pricing and convenience with the many fine insurance carriers we represent.

Contact one of our agents at the Sheaner Insurance agency for a quote or to help with your risk management plan.

Sheaner Insurance Agency June 30th, 2016

Posted In: Articles

Fire Extinguishers for Your Home

3 Important Things to Know About Fire Extinguishers

Whether your Texas home is a three-story Tudor, a skyline-grazing apartment or an RV on wheels, you need at least one fire extinguisher for it. But if you don’t have the right one, or you haven’t checked it recently, you may have a false sense of security rather than a fire-fighting device. There are a few important things to know about fire extinguishers, but they aren’t complicated. Here are three things to help you get up to speed:

- There are extinguishers for each type of fire. Class A: ordinary combustibles, such as wood; Class B: flammable liquids or gasses, such as gasoline or propane; Class C: energized electrical equipment like appliances; Class D: combustible metals; and Class K: cooking oils and greases. An extinguisher that isn’t rated for the fire you’re trying to fight likely won’t help.

- Multipurpose extinguishers are widely available. Typically rated for Class A, B and C fires, they are good for most living areas and also work on small grease fires. You need at least one for each level of your home, and one in the garage is a good idea, too. Store them in an accessible area and inspect them regularly for rust and other damage. Also follow any maintenance instructions included with the device. Some need to be shaken regularly, for example.

- Remember “P.A.S.S.” when you use your extinguisher. Pull the pin. Aim the nozzle at the fire’s base. Squeeze the lever. Sweep the nozzle back and forth. And always keep your back to an exit when fighting a fire. You need to be able to escape quickly if necessary.

Even more important than knowing how to use your fire extinguisher is knowing when not to use it. If you’d be putting yourself at risk trying to fight a fire, leave the area immediately. You should already have a family fire escape plan in place, so don’t hesitate to use it if there’s any question about your safety.

After all, your life is irreplaceable. Your insurance, however, can help you rebuild your home and replace your belongings. If you’d like to check up on your coverage, give us a call today.

Sheaner Insurance Agency June 14th, 2016

Posted In: Personal Insurance

Unattended candle can be a disaster waiting to happen

Sure, fragrant candles smell nice and create ambiance, but an unattended candle can be a disaster waiting to happen. Mike Rugh, a Pennsylvania state police fire marshal, said the top three causes of house fires are – in no paiiicular order

– candles, careless smoking and electrical issues.

In most cases, house fires caused by candles are the result of carelessness.

Sometimes, Rugh said, fires are caused by the fact that many people believe candles are safe.

In paiiicular , jar candles, which are set in a glass container resembling a jar , give a “false sense of security,” Rugh said. “People think they’re foolproof because they’re in glass,” he said.

However, as the wax bums off, the wick can get close to the glass, heating it up. That can then cause the glass to fail and explode, allowing the flaming wick to set off a much larger blaze.

“You’re subjecting an open flame to glass. It’s not going to work,” Rugh said.

Candles set in a tin container can also be dangerous, he added. As the candle bums down, it heats up the tin. That can cause whatever it’s sitting on to catch fire.

CONTAINER FILLED CANDLES

Always place candle on a heat resistant holder. When the candle bums down to the bottom of the container there could be enough heat to damage the furniture on which the candle is sitting. Keep the flame from getting too close to the container. The heat from the flame could cause the container to crack. Handle burning container candles with care. The melted wax and flame can cause the containers to be too hot to handle. To be additionally safe, when the wax level is from 1/4 to 1/2 from the bottom of container, you should discontinue use and avoid the possibility of the container cracking.

Glass containers are particularly fragile and heat concentrated in one area could cause the glass to break. Special care should be taken to protect surface and surrounding areas from hot broken glass and melted wax.

Peak month

On Sunday, a house fire in Shippensburg was blamed on a jar candle that failed.

The candle, which was in a second-floor bathroom , said Chief Clyde Tinner of the Vigilant Hose Co., burned down to nearly the bottom . Heat from the flame affected the glass, causing it break. That in tum sent the flaming wick into nearby items, catching them on fire.

The fire eventually spread to a bedroom and to the attic, Tinner said. No one was injured in the blaze, he added, but a family of four was displaced.

It was the second fire in the borough caused by a candle in two years, Tinner said.

According to the National Fire Protection Association, between 2003 and 2007, an estimated average of 15,260 house fires were staiied by candles each year.

Those fires caused an annual average of 166 civilian deaths, 1,289 civilian fire injmies and $450 million in property damage.

December is the peak month for candle fires, the NFPA says. The top five days for house fires caused by candles were Christmas, Christmas Eve, New Year’s Day, Halloween and Dec. 23.

Rugh encourages people to install working smoke alarms in their homes just in case a fire does break out. Many fire depaiiments, including Union Fire Co. in Carlisle, offer free detectors.

Shawn Brickner, chief of the Nmih Middleton Township Fire Co., advises those who bum jar candles to put them in a ceramic container so that if the glass does explode, the wick and wax will be contained.

When placing a candle somewhere to be burned, Rugh said, make sure it’s away from drafts that could fan the flame or cause a cmiain to blow over top of it. Also, he added, make sure children or pets can’t knock the candle over.

“The A-number one thing is never bum a candle unless you’re in the room with it,” Rugh said.

This article was submitted by our account manager at Servpro of Northeast Dallas, Mike Davis. Servpro provides Fire & Water cleanup and restoration services. Contact Mike at (214) 343-3973 or visit their website at www.servpronortheastdallas.com

Sheaner Insurance Agency November 10th, 2015

Posted In: Articles

Keeping Insurance Cost Down

Every year when it comes time to renew insurance I think of the old adage made famous by Benjamin Franklin, “In this world nothing can be said to be certain, except death and taxes.” Paying insurance premiums can certainly be added to that list.

Although paying insurance premium is a necessary cost of business, the amount of premium you pay is by no means certain. In this and following articles, we will explore ways to keep insurance cost manageable while maintaining the critical coverage needed to protect the business.

Risk Management: Maintaining a clean and safe work environment can be one of the most effective ways in the long run of keeping insurance cost at a minimum. Underwriters give a great deal of weight to proactive risk management techniques such as written safety controls and procedures.

Regularly scheduled safety training and continued employee education are also key components to a good risk management plan. Weekly safety meetings are an efficient way to inform employees of your strategy and expectation for a clean and safe environment for your employees and customers.

In the end, your loss history can be the difference between affordable coverage and premiums that seem to go through the roof. Longevity in business combined with a good record goes a long way in getting the best price.

Shop your coverage: While maintaining loyalty to your agent is important, it may be beneficial to compare coverage from time to time with other companies. New carriers have come into the market in the past twelve months that offer comprehensive coverage at very competitive rates. If your agent has access to other markets ask them to shop for you. If not, seek quotes from another agent or ask others in the industry if they have someone who is doing a good job for them. It never hurts to ask!

Contact one of our agents at the Sheaner Insurance agency for a quote or to help with your risk management plan.

Sheaner Insurance Agency October 2nd, 2015

Posted In: Insurance Tips